The Bank Verification Number (BVN), an 11-digit identifier, is integral to conducting secure financial transactions in Nigeria. Serving as a unique identity across banks, BVN enhances security, battles fraud, and ensures a unified identification system. Required for various banking activities, from withdrawals to online banking, BVN offers benefits like participation in investment banking and credit opportunities. Obtaining BVN involves form completion and biometric data capture at any bank. To check BVN across all banks, dial *556*0# from the registered mobile number for N20. BVN is a crucial safeguard in Nigeria's evolving financial landscape.

February 4, 2024

-3 mins read

Chizitere

Content creator

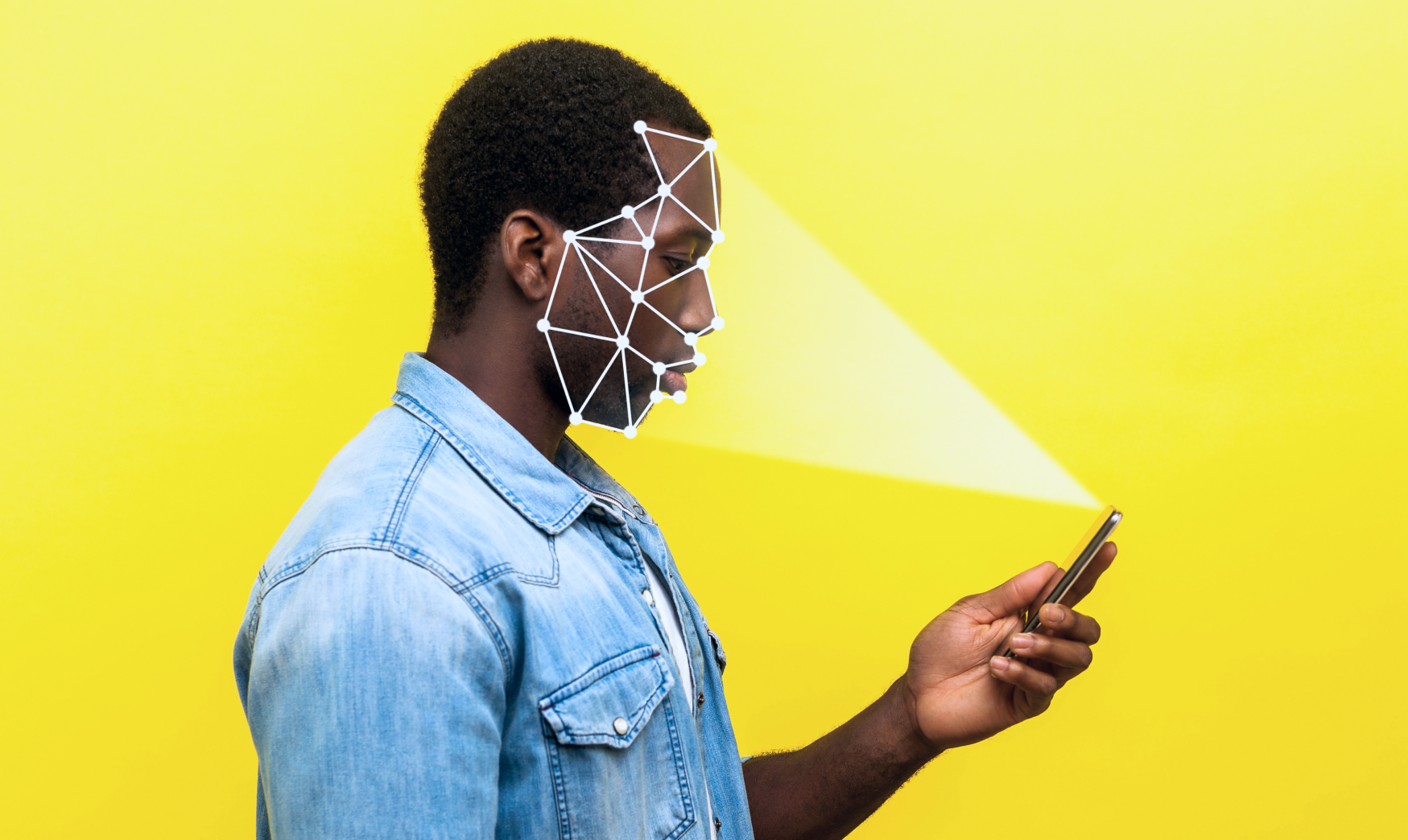

The Bank Verification Number (BVN) is an 11-digit number that gives each customer a unique identity that can be verified across the Nigerian Banking Industry, from traditional financial institutions to modern-day fintech companies like PAYED.

Without your BVN, it is almost impossible to conduct meaningful financial business in Nigeria. This is because the BVN serves as an identification document for the customer and gives access to sensitive and personal information within the banking system. More importantly, it helps battle fraud and other related security issues in the Nigerian financial ecosystem.

With the rising issues of fraud and the increasing incidents of compromise of the banking security systems in Nigeria, a unique code tied to each individual with a bank account was created. The code, otherwise known as the BVN, gives account holders a single identity across all Nigerian banks, which means that the BVN number can be used as a form of identification in any Nigerian bank.

The Central Bank of Nigeria, in collaboration with all Nigerian banks, came up with BVN to provide greater security for access to sensitive or personal information in the Banking System. The code was designed to be required for all banking activities, from making withdrawals to requesting and replacing an ATM card. You also need the code to register for online banking, use the bank mobile app, upgrade account, and much more.

Outside of the identification and security reasons behind the creation of the BVN, a few benefits have been tied to the linking of a BVN to an account. These benefits include allowing bank customers to participate in future investment banking transactions and access to future credit opportunities.

To retrieve your BVN, simply dial *556*0# on your registered mobile number. The USSD code allows you access your Bank Verification Number (BVN) in all commercial banks in Nigeria without having internet connectivity. This costs N20.

If you enjoyed this article, share it with the world.